Many Sumter County voters assume that the 2019 25.6% property tax rate increase is not an issue in the August 23 Primary election. But most voters do not realize that they also paid for that tax increase in 2020 and 2021, and will be paying in 2022, etc. In the August 23 Primary election, the voters have the opportunity to elect four new Sumter County Commissioners. The right commissioners could significantly reduce everyone’s property tax rate, by increasing the impact fees paid one time when a new building is constructed. Currently, there are no Democrats, Independents, or write-in candidates running for the four county commission seats on the Primary ballot; therefore, all registered voters should vote in the Aug. 23 Primary.

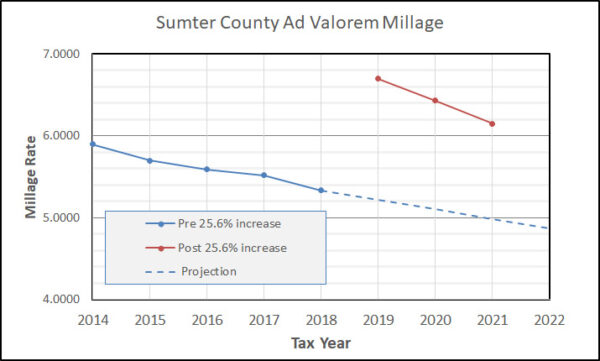

Shown below is a graph of the tax rate for the years 2014 to 2021.

The tax rate was going down before 2019. The total annual property tax revenue collected by the county is the Millage Rate times the Total Taxable Value of all the property in the county. Housing price inflation and new homes and new buildings drive up the Total Taxable Value and typically produce a reduction in the Millage Rate. The dotted line does show the expected trend if there was no 25.6 percent rate increase in 2019. Using this trend line, the added tax burden on your property can easily be calculated using the simple worksheet that can be downloaded via this Google Drive Link.

For your amusement, the following is the total added property tax burden for the years 2019 through 2021 for the residences of:

Mark Morse $2,072

Roberta Ulrich $1,175

Donald Wiley $830

James Morris $706

Doug Gilpin $366

Your Residence $????

The property tax bills for you and the above people are public records accessible at this link.

What can you do before the Aug. 23 Primary election? You can Insist that all the candidates for the Sumter County Commission clearly state their position on increasing the one-time impact fees for new building construction; it is unlikely that you will find their position on this subject in their current campaign material. Do your homework and vote in the August 23 Primary. It is important that there are at least 4 of the five new commissioners support increasing impact fees. Because of the provisions of the 2021 Brett Hage state law, four of our five county commissioners must vote yes to increase impact fees.

Currently, the Sumter County impact fee is $2,666 for a single-family home but is only $976 for a new home in The Villages; Sumter only has a road impact fee. Lake has impact fees for roads, schools, fire, parks, and libraries. The Lake County impact fee is $10,830 for a single-family home but is only $1,251 for a new home in a retirement community; new homes in a retirement community do not pay the school impact fee.

John Kastura is a resident of The Villages.