You are scheduled to speak at the POA on July 19. I will be in that audience. There are issues that most of the audience, including me, are very concerned about. Many are worried about the impact of inflation on their lives; this includes their 2022 property taxes and the services provided by the county.

The issues that I believe are important to the audience at that POA meeting are shown below and should be covered in your presentation.

Clarification of how the milage tax rate is determined. This is my current understanding:

- First, you determine what expenditures are needed for the budget year. A July 13 story in the Daily Sun states that it is $310 million.

- In parallel, the Sumter County Property Tax Assessor determines the total Taxable Value of all the properties in Sumter County.

- The amount of revenue needed from property taxes is the total required expenditures minus the revenue from other sources (examples are the county share of the sales tax, COVID relief grants, and other grants).

- Then the millage rate is calculated as the total-needed-revenue from property taxes divided by the total-taxable-value of all the properties in the county.

‘Last Year’s 25% Spending Hike’

A story in the July 13 Daily Sun states that “Unlike last year’s 25% spending hike……..” What was the actual spending increase, and how much was it due to the spending of state and federal grants with restrictions on how that money is spent? Examples are grants like COVID relief, etc.

Clarification of Millage Rate, Property Taxable Value, & Property Tax. And when will people know what the amount will be for the Sumter County “Taxes Levied” item on their 2022 property tax bill.

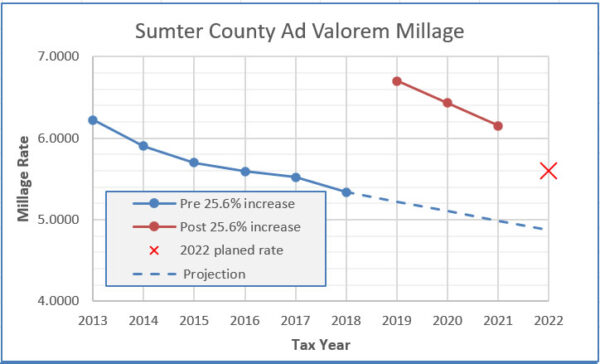

Shown below is a graph of the Sumter County Ad Valorem Millage. The red X is the 5.5900 rate stated in the July 12 Daily Sun. The blue dashed line is my projection of what the millage rate would be if the 2019 25.6% millage increase had not occurred.

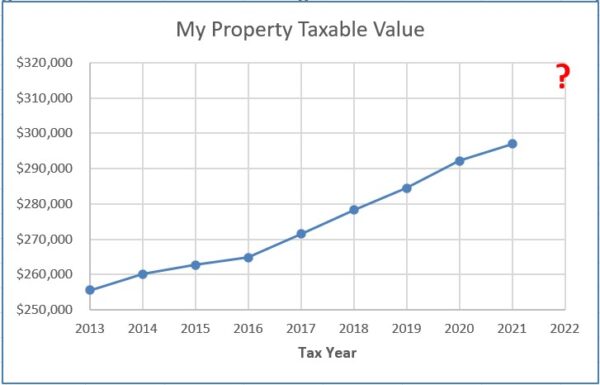

Shown below is the Taxable Value of my property that appeared on my tax bills. With the current housing price inflation, what will happen to the taxable values for the tax year 2022?

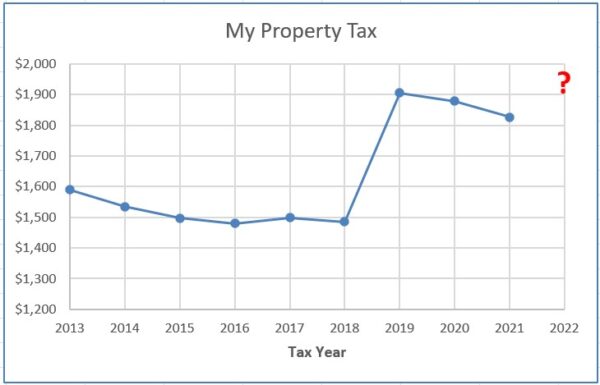

The following graph shows my county property taxes. Everyone may not know that if their property taxable value increases significantly, a small decrease in the millage rate will not reduce their 2022 taxes will be more than 2021.

John Kastura is a resident of the Village of Belvedere.