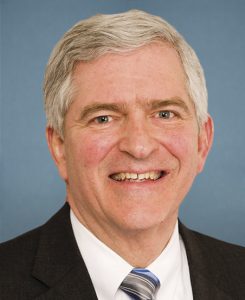

Florida Congressman Daniel Webster has once again cosponsored the bipartisan Senior Citizens Tax Elimination Act, HR 3971, which assists middle-class seniors by eliminating the double tax on Social Security benefits.

“For decades, seniors have paid into Social Security with their tax dollars. Now, when many seniors are on a fixed income and struggling financially, they are being double-taxed because of income taxes on their Social Security benefits,” Webster said. “This is wrong and I’m pleased to once again co-sponsor this legislation to repeal this tax.”

According to the Congressional Research Service, “Until 1984, Social Security benefits were exempt from the federal income tax. In 1983, Congress approved recommendations from the National Commission on Social Security Reform (also known as the Greenspan Commission) to tax Social Security benefits above a specified income threshold.”

Dan Weber, president and founder of the Association of Mature American Citizens, backed Webster’s stance on the measure.

“Every year, millions of seniors become eligible for either Social Security or tier I railroad retirement benefits,” he said. “After working for decades, being involuntarily taxed on their hard-earned income to fund these federal programs, some seniors are forced to pay income tax on the benefits they withdraw from the federal government.”

Weber said taxing the benefits created from taxed earnings is “completely nonsensical” and diminishes the retirement benefits seniors have been promised.

“Seniors deserve to reap the full benefits of their career-long contributions to Social Security and the Railroad Retirement Plan,” he said. “As this legislation takes effect, seniors will notice their tax liability is significantly reduced, and will no longer deal with the ‘double tax’ on their federally earned benefits.”

Republican Rep. Thomas Massie, of Kentucky, who reintroduced the bill last week, agreed.

“Although seniors have already paid tax on their Social Security contributions via the payroll tax, they are still required to list these benefits as taxable income on their tax returns,” he said. “This is simply a way for Congress to obtain more revenue for the federal government at the expense of seniors who have already paid into Social Security. My bill would exempt Social Security retirement benefits from taxation and boost the retirement income of millions of older Americans.”

“When you rely on a fixed income, every dollar counts,” Republican Rep. Troy Balderson, of Ohio, said. “This is the case for many of our country’s senior citizens who can’t afford an unfair double-tax on their hard-earned Social Security benefits.”